- Educación

- Psicología de comercio

- Incapaz de aceptar una operación perdedora

Psychology of Trading: Unable to Accept a Losing Trade

Imagine this scenario: a trader has invested in the market, believing that it'll soon rise, but the market is falling. He waits for the situation to turn in his favor, while the market continues to fall. Instead of closing the trade and cutting his losses, the trader continues to wait for fear of losing the money he has already invested. He tells himself that he will exit as soon as he loses a certain amount of money, but instead, he holds the trade and allows the losses to grow.

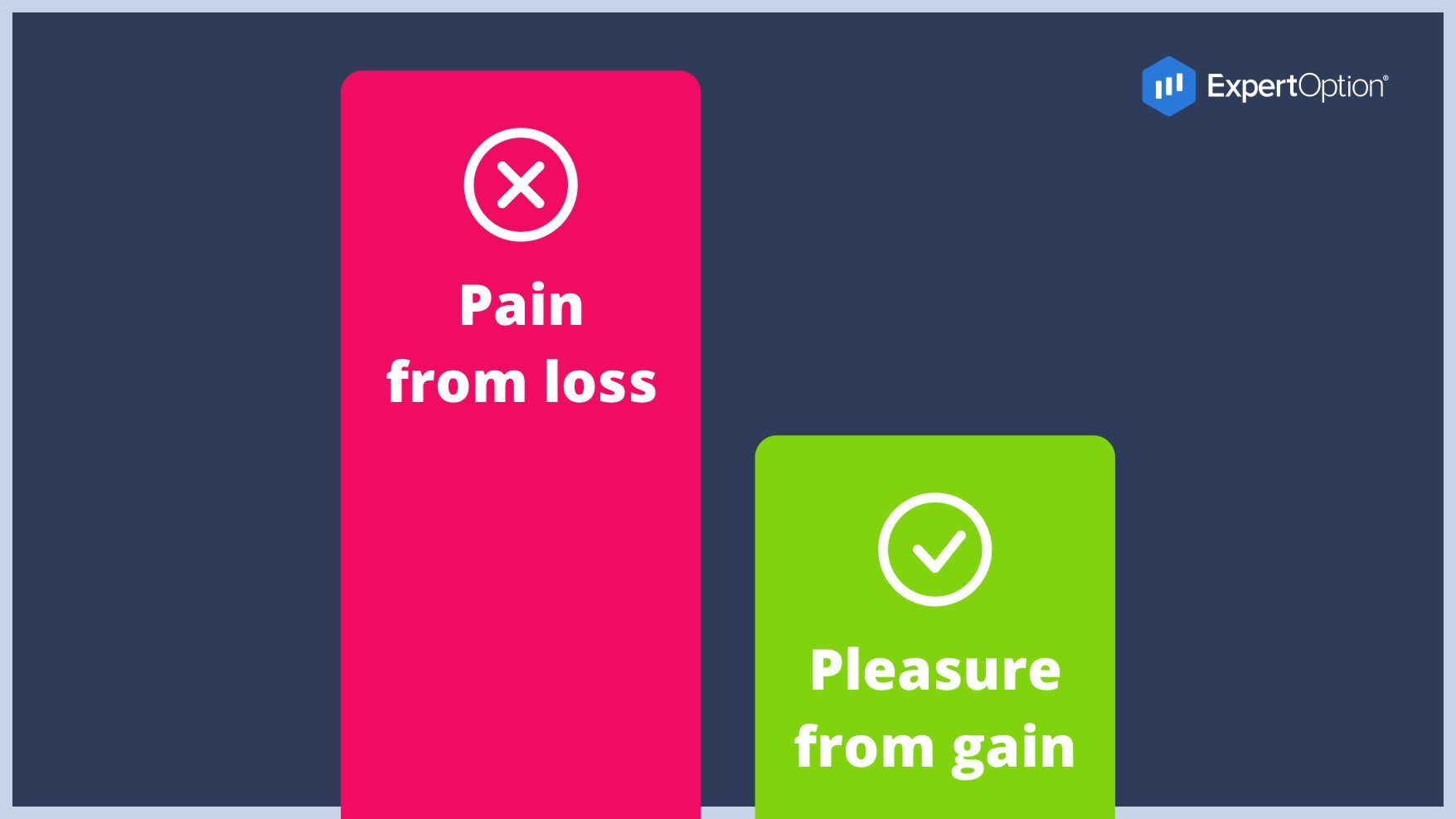

The inability to accept a loss is a situation in which a person tries to avoid losses rather than making gains. People tend to think that if the odds are the same for any scenario, it's better to not lose $100 than to find $100. Many studies have shown that most people tend to feel the pain of loss more intensely than the pleasure of gain. The emotional value associated with loss prevents a person from making logical decisions. Not being able to accept losses is a natural human reaction, but it can lead to chaos in your trading account if you don't learn to deal with it.

Failure to accept a loss causes you to deviate from your original trading strategy. By not adhering to the rules of risk management (for example, planning, setting, and adhering to stop-losses), you are allowing your losses to become larger than originally planned. These unanticipated additional losses can quickly turn a profitable system into a mess. None of us likes to lose. But by becoming a victim of loss aversion, your trading method is no longer based on cold-blooded calculations, which leads to poor results and ineffective trading.

According to research by Kahneman and Tversky in 1979, our brains typically attribute 2.5 times more weight to losses than to gains. In the study, participants were asked if they preferred to lose $7500, or if they could “roll the dice” with a 75% chance of losing $ 10000 and a 25% chance of losing $0. Most people preferred to gamble.

When it comes to trading, you can either take your loss and walk away or let it rise continuously. If you choose the latter, the chances are that you could ride out the drawdown, but there's also a chance that you end up losing even more. The real problem is that if you wait for the drawdown to pass, your irrational behavior will be rewarded. You know you went wrong by going against your stop loss and trading plan rules, but it worked anyway. This is a trap that lures many new traders.

How to work with it?

First of all, keep in mind that a good trader needs volatility and risk, without these two factors, trading would not exist. Therefore, losing is part of your trading plan. Once you have a grasp of this psychological trap, you can handle most trading situations.

You must not only understand and accept this but also practice working with these emotions daily. The best way to overcome feelings of loss aversion and build discipline is to stay in the trade for a longer time, allowing the price to reach the stop level or target that you set for it in the beginning. Stay patient and learn to deal with your emotions knowing that your goal is set, your risk is under control, and your plan is being implemented.

Trading is an emotional exercise. If you allow emotions and innate cognitive biases to take over your rationality and logic, your trading performance is likely to suffer. Good trade management is all about asset protection and loss management, so tools like stop loss are essential if you have long-term goals.

Every professional trader suffers losses, learns from his mistakes, and moves on to another opportunity. Always follow your plan and have an exit strategy hidden up your sleeve. And keep in mind: it's okay to do something wrong, to be wrong.